Veteran Debt Relief

Authored by

Natalia Brown

Authored by

Natalia Brown

Reviewed by

Timi Joy Jorgensen, PhD

financial education, planning, financial education, financial stress, financial management, women and financial services

Utah Valley University, University of Georgia

PhD

Reviewed by

Timi Joy Jorgensen, PhD

financial education, planning, financial education, financial stress, financial management, women and financial services

Utah Valley University, University of Georgia

PhD

- Veterans face unique debt challenges after transitioning to civilian life.

- Common causes of debt include moving, medical costs, and lengthy career transition.

- VA disability benefits are mostly protected but may be reduced for federal debts.

- Financial aid programs offer grants, housing help, and emergency support.

- Scams targeting veterans include fake loans, debt relief fraud, and pension advances.

You’ve served your country—now it’s time to take care of yourself.

As you transition to civilian life, it’s not unusual to face new financial pressures. From job searches to healthcare costs and housing challenges, many veterans encounter unexpected debt. This guide is here to help you understand your options, protect your benefits, and connect with trustworthy support resources designed specifically for veterans and their families.

Free Consultation with a Certified Debt Specialist

Start with a Free No-Obligation Consultation

You’ve served your country—now it’s time to take care of yourself.

As you transition to civilian life, it’s not unusual to face new financial pressures. From job searches to healthcare costs and housing challenges, many veterans encounter unexpected debt. This guide is here to help you understand your options, protect your benefits, and connect with trustworthy support resources designed specifically for veterans and their families.

Start Paying off Your Veteran Debt Today!

The Causes Of Veteran Debt

Many veterans face unique financial pressures that can contribute to long-term debt. These challenges often begin during the transition to civilian life and can be compounded by systemic issues such as delayed benefits, healthcare costs, and limited access to financial resources.

Reason for debt

Moving Often

33%

Medical expenses

15%

Pensions/ not enough income

41%

Difficulty finding a job after serving

43%

Missing bills while on deployment

17%

Other

17%

Moving Expenses

While the military may cover some relocation costs for retiring service members or those being involuntarily separated, most veterans transitioning to civilian life aren’t eligible for this assistance. Moving expenses can add up quickly—especially for cross-country moves or families with children.

For example, the average cost of a long-distance move (approximately 1,000 miles) is around $4,890 for a 2-3 bedroom home, while local moves average about $1,250. If you’re unable to pay upfront, taking on debt may be your only option.

Civilian Living Expenses

Transitioning to civilian life entails assuming personal responsibility for expenses previously subsidized or provided by the military, such as insurance and housing. In 2024, the average annual health insurance premium was $8,951 for single coverage and $25,572 for family coverage.

Housing costs also present a significant financial commitment, with the national median monthly rent reaching $1,595 as of November 2024. Additionally, without access to military commissaries, grocery expenses may rise, further impacting your budget.

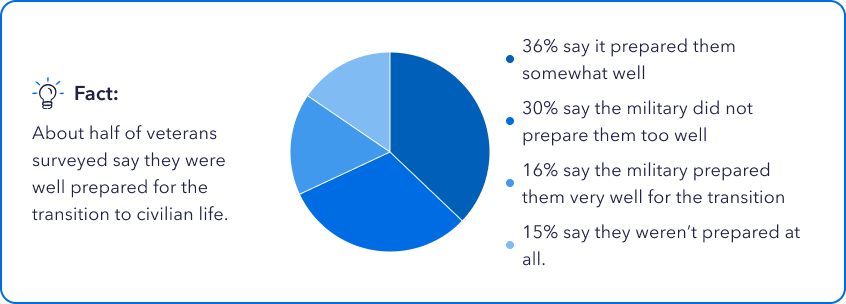

Challenges During the Transition to Civilian Life

Reentering civilian life can be financially disruptive. While the overall unemployment rate for veterans was 2.8% in 2024, younger veterans—especially those aged 18 to 24—continue to face significantly higher unemployment compared to their nonveteran peers.

The loss of steady military income, combined with difficulties finding comparable civilian jobs, can create immediate financial stress and push some veterans to rely on credit cards, loans, or other forms of debt to stay afloat.

Service-Related Disabilities and Medical Expenses

Medical issues stemming from service can add another layer of financial burden. As of August 2024, nearly one-third (31%) of veterans reported having a service-connected disability. These conditions often lead to ongoing healthcare costs or limit a veteran’s ability to work, which can strain household budgets. Even with VA coverage, out-of-pocket medical expenses or the need for specialized care may lead some veterans into medical debt.

Delayed or Insufficient Benefits

While VA benefits are a lifeline for many, delays in processing claims can leave veterans waiting months for essential financial support. As of September 2023, the VA had more than 635,000 disability claims pending, with over 152,000 of them considered backlogged. During these delays, veterans may resort to borrowing to cover basic living costs, leading to growing debt burdens.

Impacts from Debt

Lost Sleep

68%

Delaying Life Events

(e.g. marriage, children, retirement)

50%

Conflict in relationships

52%

Saying no to social events

49%

Stress

84%

None of the above

5%

Housing Instability

Housing insecurity is another major contributor to veteran debt. In January 2024, 32,882 veterans were identified as experiencing homelessness or unstable housing situations. Without stable housing, it becomes even harder to secure employment, manage finances, or access support services—making it more likely that individuals fall deeper into debt.

Limited Financial Literacy Resources

Many veterans and military households face a knowledge gap when it comes to personal finance. Studies show that military families are more likely than civilians to use non-bank financial products such as payday loans and cryptocurrency, which often come with high risks and costs. Without access to reliable financial education, veterans may unknowingly take on predatory loans or mismanage debt, worsening their financial outlook.

Overpayment of VA Benefits

Mistakes in VA administration can also put veterans in difficult financial positions. Overpayments—often the result of unreported income changes or clerical errors—require veterans to repay money they may have already used for rent, food, or healthcare. These unexpected repayment demands can destabilize finances, especially if the veteran was unaware of the overpayment until receiving a collections notice.

Spousal Unemployment

Veteran households often rely on two incomes to maintain financial stability. However, many veterans transition out of service with spouses who have faced prolonged periods of unemployment or underemployment due to the demands of military life. Frequent relocations, caregiving responsibilities, and limited access to consistent career opportunities contribute to high unemployment rates among military spouses—21% as of early 2024, nearly six times the national average of 3.7%.

Although this statistic reflects military spouses, the impact often extends into post-service life. Resume gaps, lack of career progression, and the need to reestablish employment in new locations can make it difficult for spouses to secure stable work even after the veteran leaves active duty.

VA Disability Benefits and Debt Repayment

One of the most important distinctions for veterans is how VA disability benefits are treated in debt relief scenarios. These benefits are generally protected and cannot be garnished by creditors to repay consumer debts such as credit cards or personal loans. However, there are some exceptions worth noting.

Federal Debts May Still Be Collected

If you owe money to a federal agency—such as the IRS or the Department of Education—your VA disability payments may be offset through programs like the Treasury Offset Program (TOP). This includes:

- Unpaid federal taxes

- Defaulted federal student loans

- Other government-issued loans or obligations

While private lenders can’t touch your VA benefits, the federal government can intercept a portion of them to satisfy debts owed directly to it. The amount withheld is often limited to ensure you retain a minimum income, but these offsets can still create financial stress if you rely on those payments to cover basic needs.

Overpayments From the VA

In some cases, the Department of Veterans Affairs may overpay benefits due to processing errors, changes in eligibility, or incorrect information. If this happens, the VA is legally allowed to recoup the overpaid amount by reducing your future disability payments until the debt is repaid. This process is known as a VA offset.

Many veterans aren’t even aware of an overpayment until they receive a debt notice or see a reduction in their monthly compensation. If you believe you’ve been overpaid or disagree with the VA’s decision, you have the right to request a waiver, appeal the debt, or set up a repayment plan to ease the burden.

When Benefits Are Deposited Into a Bank Account

Even though VA benefits are protected, complications can arise after the money is deposited into your bank account. If your account is subject to a judgment or levy from a creditor, the bank may temporarily freeze funds—even those that are legally exempt—until the origin of the money is confirmed.

Under federal banking regulations, financial institutions are required to protect up to two months’ worth of VA benefits from garnishment, but any commingled funds (such as mixing VA benefits with other sources of income) can complicate things. To help safeguard your benefits:

- Avoid mixing protected benefits with other income sources in the same account, if possible.

- Keep records showing the origin of your VA deposits.

- Notify your bank immediately if you believe protected funds are being improperly withheld.

Veteran Assistance Programs

As a military member, you have access to assistance programs aimed at helping you overcome financial hurdles.

VA Pension

The Veterans Pension Program provides tax-free monthly payments to wartime veterans who meet certain income, asset, and service requirements. This benefit is designed to support veterans who are elderly, disabled, or experiencing financial hardship—especially those who struggle to cover basic living expenses on a fixed income.

To be eligible for a VA Pension, a veteran must meet all of the following criteria:

- Service Requirements:

- Served at least 90 days of active military service, with at least one day during a wartime period (as defined by the VA)

- Entered active duty before September 8, 1980

- If service began after September 7, 1980, you generally must have served 24 months or the full period for which you were called to active duty

- Discharge Status: Must have received an honorable or general discharge under honorable conditions

- Financial Need:

- Have countable income and net worth below the limits set by Congress

- Income includes earnings, pension/retirement income, and Social Security benefits, minus allowable medical expenses

- Age or Disability: Be 65 or older, permanently and totally disabled, a patient in a nursing home, or receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI)

Veterans Affairs Life Insurance (VALife)

VALife, or Veterans Affairs Life Insurance, is a guaranteed acceptance whole-life insurance program designed specifically for veterans with service-connected disabilities. It helps bridge a major gap in traditional life insurance coverage—especially for veterans who may struggle to qualify due to pre-existing conditions related to their military service.

To qualify for VALife, you must:

- Be a veteran of the U.S. Armed Forces

- Be age 80 or under

- Have a service-connected disability rating from the VA (0% to 100%)

Operation First Response Family Assistance Program

This program supports wounded veterans and their families as they transition out of service or await VA benefit determinations. Funds can be used for critical needs like rent, utilities, groceries, and transportation. The goal is to maintain financial stability during a time when benefits may be delayed.

Semper Fi & America’s Fund Service Member & Family Support Program

Semper Fi & America’s Fund provides direct financial assistance to wounded, ill, and injured veterans of all military branches. Their Service Member & Family Support program covers needs like housing, caregiver assistance, transportation, and medical costs not covered by the VA.

Combat Female Veterans Families United (CFVF United)

CFVF United offers emergency financial aid to female combat veterans transitioning back to civilian life. Assistance may cover housing, basic living expenses, education support, and other resources tailored to women veterans.

Dixon Center Women Veterans Emergency Financial Assistance

The Dixon Center provides one-time emergency financial grants to female veterans and their families. Funds may be used for essential needs such as housing, gas, childcare, job training, and medical care, helping to bridge gaps during difficult transitions.

Veterans of Foreign Wars (VFW) Unmet Needs Program

This program provides financial grants (up to $1,500) to veterans and active-duty military facing unexpected financial hardship due to deployment or service-related injuries. Grants help cover rent, mortgage, utilities, and other basic living expenses.

Operation Family Fund

This organization provides financial assistance to severely wounded veterans from Operation Enduring and Iraqi Freedom. Grants can help cover living expenses, vehicle modifications, medical costs, and other critical needs as veterans rebuild their lives.

Hope for the Warriors

Hope for the Warriors offers a range of veteran support services, including financial assistance, career readiness programs, and mental health support. Their critical needs program provides emergency grants to prevent homelessness, utility shut-offs, and food insecurity.

Coalition to Salute America’s Heroes

This organization assists post-9/11 veterans who are severely injured and struggling to regain financial independence. Emergency financial aid helps cover mortgages, utilities, medical expenses, and household needs.

How to Protect Yourself From Financial Scams Targeting Veterans

Unfortunately, veterans are frequently targeted by scammers who take advantage of military benefits, government programs, and the challenges of transitioning to civilian life. These scams can lead to financial losses, identity theft, and even benefit disruptions. Knowing the red flags can help you protect yourself and your hard-earned income.

Here are some of the most common scams that specifically target veterans—and how to avoid them.

Fake VA Loan Offers

Scammers often pose as lenders or official VA representatives offering “special VA home loan deals” or refinancing options that sound too good to be true. These offers may come through unsolicited phone calls, emails, or mailers and often use official-looking logos or patriotic language to gain your trust.

Red Flags to Watch For

Be cautious if you encounter any of the following:

- Promises of ultra-low interest rates that seem well below market averages

- Claims of “limited-time offers” or immediate deadlines to maintain eligibility

- Requests for upfront fees, especially via wire transfer, prepaid card, or digital payment app

- Communication from email addresses that don’t match the organization’s domain or phone numbers not listed on the official VA website

- Offers to “skip” multiple payments or receive cash out with minimal documentation

How to Protect Yourself

If you’re exploring a VA loan or refinancing option, take these steps to ensure you’re dealing with a legitimate lender:

- Work only with VA-approved lenders. You can confirm a lender’s approval status on the VA’s lender search tool.

- Don’t respond to unsolicited calls or emails about your loan without verifying the source.

- Check rates and offers independently through trusted financial institutions or through VA.gov.

- Look for fine print. Many deceptive mailers have legal disclaimers in tiny font admitting the company is not affiliated with the VA.

- Report suspected scams to the Federal Trade Commission (FTC) and notify your VA regional office.

For more information on how to avoid scams targeting veterans and military members, check out the Better Business Bureau’s scam prevention page.

Debt Relief Scams

Some scammers advertise “veteran debt relief” programs or loan forgiveness services that promise to eliminate your debt—for a fee. These fraudulent companies often charge large upfront costs or monthly service fees but deliver little to no actual help.

Red Flags to Watch For

Scam debt relief companies often display one or more of the following warning signs:

- Promises to erase debt “fast” or “completely”—especially without reviewing your full financial picture

- Upfront payments required before any work is done

- High-pressure sales tactics pushing you to enroll right away

- Guaranteed results, such as credit score boosts

- Claims of special VA or DoD affiliations—especially if they don’t provide documentation

How to Protect Yourself

If you’re considering debt relief, take these steps to ensure you’re working with a legitimate, veteran-aware organization:

- Verify credentials. Look for accreditation from organizations like the American Association for Debt Resolution.

- Avoid any company that demands payment upfront. Under the Federal Trade Commission’s Telemarketing Sales Rule, debt relief companies are prohibited from collecting fees before delivering services.

- Check for complaints. Research the company through the Better Business Bureau (BBB) or review sites like Trustpilot.

- Get everything in writing. A reputable agency will explain all fees, timelines, and potential risks clearly.

Pension Advance Scams

Pension advance schemes offer a lump sum of cash in exchange for a portion of your future VA pension or military retirement pay. While these may look like quick fixes, they’re often predatory in nature, with interest rates that can reach well over 100% APR—trapping veterans in cycles of debt.

It’s important to understand that you cannot legally assign or sell your VA pension or military retirement pay to a third party. These benefits are protected under federal law, and any company that claims to “manage” them on your behalf is likely breaking the law.

Red Flags to Watch For

Be on high alert if you encounter:

- An offer of a large, fast lump sum with few eligibility requirements

- A company asking you to redirect your VA or military retirement pay through a new bank account

- Contracts that are difficult to understand, include long repayment terms, or lack clear APR disclosures

- Pressure to sign quickly, with little time to review terms

- Claims that this is “not a loan,” “totally legal,” or “approved by the VA”

How to Protect Yourself

These tips can help you protect your benefits and avoid long-term financial harm:

- Never sign away your rights to your VA pension or military retirement pay.

- Work only with accredited financial advisors or Veterans Service Organizations (VSOs) who can help you explore safe financial options.

- If you’re in urgent need of funds, look into VA financial hardship programs, emergency grants, or nonprofit assistance designed specifically for veterans.

- Review any contract with a legal or financial expert before agreeing to a lump-sum pension advance.

Commonly Asked Questions

What does the VA consider a financial hardship?

If you’re struggling due to life circumstances—such as job loss, a sudden drop in income, or increased out-of-pocket medical expenses—you may qualify for VA financial hardship assistance. This can include:

- Waiving or exempting future VA copays

- Repayment plans or debt forgiveness for current VA medical bills

You can request financial hardship relief through the VA Health Care System by completing VA Form 10-10HS or contacting the VA Debt Management Center.

What financial benefits are available from the VA?

The VA provides a range of financial and support benefits for eligible veterans, including:

- Disability compensation

- VA pension for low-income wartime veterans

- Education and training programs (e.g., GI Bill)

- VA-backed home loans

- Health care services

- Life insurance options (e.g., VALife)

- Veteran Readiness and Employment (VR&E)

- Burial and memorial benefits

Why would the VA deny my benefits?

Common reasons why the VA may deny disability claims include:

- Missing or incomplete information

- Lack of supporting medical evidence

- Not meeting eligibility criteria

- Delays or errors in documentation

You can appeal a VA decision or work with a Veterans Service Officer (VSO) to help improve your application.

Can I make too much money to receive VA disability benefits?

No. There are no income limits for VA disability compensation. VA disability benefits are based entirely on the severity of your service-connected condition, not your financial situation.

I have already obtained one VA loan. Can I get another one?

Yes, depending on the circumstances. Normally, if you have paid off your prior VA loan and disposed of the property, you can have your used eligibility restored for additional use. Also, on a one-time only basis, you may have your eligibility restored if your prior VA loan has been paid in full, but you still own the property. To obtain eligibility, you must send a completed VA Form 26-1880 to their Atlanta Eligibility Center.

To prevent delays in processing, it is also advisable to include evidence that the prior loan has been paid in full and, if applicable, the property disposed of. This evidence can be in the form of a paid-in-full statement from the former lender, or a copy of the HUD-1 settlement statement completed in connection with a sale of the property or refinance of the prior loan.

What is the maximum amount of a VA home loan guarantee?

There’s no maximum VA loan amount, but the VA typically guarantees up to 25% of the loan amount, which helps lenders offer favorable terms without requiring a down payment. Your credit score and income will still factor into the loan approval, as the VA doesn’t lend directly—private lenders issue the loans, and the VA provides the backing.

What is the 55-year rule for VA disability?

The 55-year rule is an internal VA guideline that reduces the likelihood of future reexaminations for disability benefits. If you’re age 55 or older, the VA typically won’t schedule routine medical reevaluations, unless there is evidence of fraud or a clear indication that your condition has significantly improved.

What VA disabilities are considered permanent?

Certain disabilities are automatically considered permanent and total (P&T) if they are unlikely to improve and significantly impair your quality of life. Examples include:

- Loss of use or amputation of arms or legs

- Total blindness in both eyes

- Total deafness in both ears

- Severe traumatic brain injury

- Some severe mental health conditions

- Certain types of terminal cancers

- Conditions that result in the veteran being permanently bedridden

If you believe your condition qualifies as permanent, you can request that your status be reviewed by the VA. A P&T designation may exempt you from future reexams and open the door to additional benefits (e.g., education benefits for dependents, property tax exemptions in some states).

For help with disability claims, you can contact a Veterans Service Organization such as:

All You Need To Know

We’ve put all of our essential resources in one spot. Everything from debt resolution to taking control of your financial future . Need to talk? Our experts are here to help. Call us anytime for a free no-obligation consultation.

Pay off your veteran debt

- Receive A Free Savings Estimate Today

- See How Quickly You Can Be Debt Free

- No Fees Until Your Accounts Are Settled

Essential Reading

The latest debt relief news, tips, and resources from our team.

We’ve transformed the lives of more than 500,000 people

Now I wake up knowing that I am paying off my debt, it’s like a weight lifted off my chest and I can breathe a bit more.

“The anxiety is gone, I am credit card debt-free. And that right there, I never thought I would be able to say those words, and it just feels so good.”

Michelle saved 23% on her debt

Now I’m able to go on vacation for the first time in a long time- I was able to go and relax. I couldn’t do that before.